How to Start ESG Reporting in Nigeria Without Getting Overwhelmed

KEY TAKEAWAYS

- ESG reporting will become mandatory for public interest companies by 2027 (2030 for SMEs) in Nigeria

- Begin with a materiality assessment to identify Nigeria-specific ESG risks (e.g., energy transition, community engagement).

- Leverage free frameworks like the Nigerian Exchange (NGX) Sustainability Disclosure Guidelines to avoid complexity.

- Prioritize 3–5 core metrics aligned with your industry (e.g., emissions for oil/gas, smallholder inclusion for agribusiness).

- Collaborate with local organizations like Teasoo Consulting for support.

- Progress > perfection: Start small with annual CSR disclosures and scale gradually.

If you’re a Nigerian business leader hearing “ESG” and thinking “Where do I even start?” You’re not alone. With new NGX requirements and global supply chain pressures, ESG reporting feels urgent. But it is important to note that Nigerian companies need pragmatic ESG entry points, not boilerplate EU frameworks. Focus on local impact first like waste management in Lagos or ethical supply chains in agriculture.

Why ESG Reporting Matters Now

Nigeria’s Financial Reporting Council (FRC) and Stock Exchange are rolling out sustainability disclosure mandates under IFRS S1/S2, with voluntary compliance expected by 2027 (2028 for public interest entities, 2030 for SMEs).

- This shift signals growing investor scrutiny on climate, governance, and social responsibility.

- Studies show stronger ESG disclosure in sectors like oil & gas and manufacturing correlates with higher firm value, Tobin’s Q, EBITDA, especially when disclosures are robust and credible

A 5-Step Plan to Start ESG Reporting

1. Conduct a Materiality Snapshot

- Action: Survey 10–15 key stakeholders (employees, community leaders, regulators) asking: “What ESG issues most affect our operations in Nigeria?”

- Why it works: Avoids drowning in 100+ metrics. Focuses on local priorities like water stewardship (Northern Nigeria) or anti-corruption (extractives).

2. Adopt a Starter Framework

- Use Nigeria Stock Exchange’s (NGX) simplified disclosure template or GRI Standards (free basic version).

- Skip: Complex EU CSRD/SASB initially.

The NGX guidelines map global standards to Nigerian business contexts.

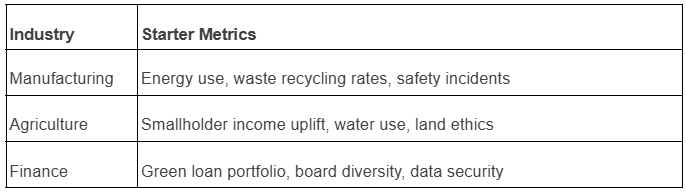

3. Pick 3–5 Core Metrics to Track

Prioritize based on your materiality snapshot:

4. Leverage Free Local Resources

- ESG Africa: Free workshops on carbon footprinting.

- UN Global Compact Nigeria: ESG self-assessment tool.

- Nigerian Climate Innovation Center: Grants for sustainability projects.

5. Integrate Gradually

- Year 1: Add ESG appendix to annual reports using NGX template.

- Year 2: Expand to 10 metrics + basic impact narrative.

- Year 3: Pursue external assurance.

Overcoming Common Nigerian Challenges

- Data Gaps? Start with estimates (e.g., fuel consumption × NERC emission factors). Update quarterly.

- Budget Limits? Use SEC’s SME sustainability grants or partner with university students (UNILAG, ABU offer ESG practicums).

- Greenwashing Fears? Be transparent: “We reduced diesel use by 15% but still use generators, solar is our 2025 priority.”

Final Takeaway

You don’t need to do everything at once. Start with a few priority issues, use local guidance, build data collection step by step, and seek support where needed. By 2027–2030, you’ll have strong ESG practices, regulatory compliance, and investor credibility all without burning out. If you’re still too confused, reach out to our experts at Teasoo Consulting and get an initial free consultation.