The main reason many Nigerians think of “Japa” is for the economic liberation they have envisioned, especially when they convert the salary they will receive abroad to Naira, bearing in mind the high and fluctuating foreign exchange rates in Nigeria. Whether going to the United Kingdom (UK) or the United States of America (USA), the thoughts are the same.

In this article, we will try to demystify this myth by looking at the case of the average Nigerian dreaming of “Japa” because they believe that earning £3,000 monthly in the UK (which translates to about N6.0m when converted to naira) is better than earning ₦1.5 million in Nigeria. The major point of analysis and comparison here is spending the money WHERE you live and earn it because a closer look at cost-of-living realities in each location tells a more balanced story. We will also be assuming we are looking at a family of 4 (Father, Mother and 2 Children).

Income Comparison:

- Before Tax – UK: £3,000/month Nigeria: ₦1,500,000/month

- After Tax – UK: £2,500/month Nigeria: ₦1,200,000/month

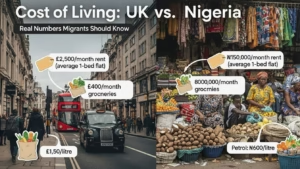

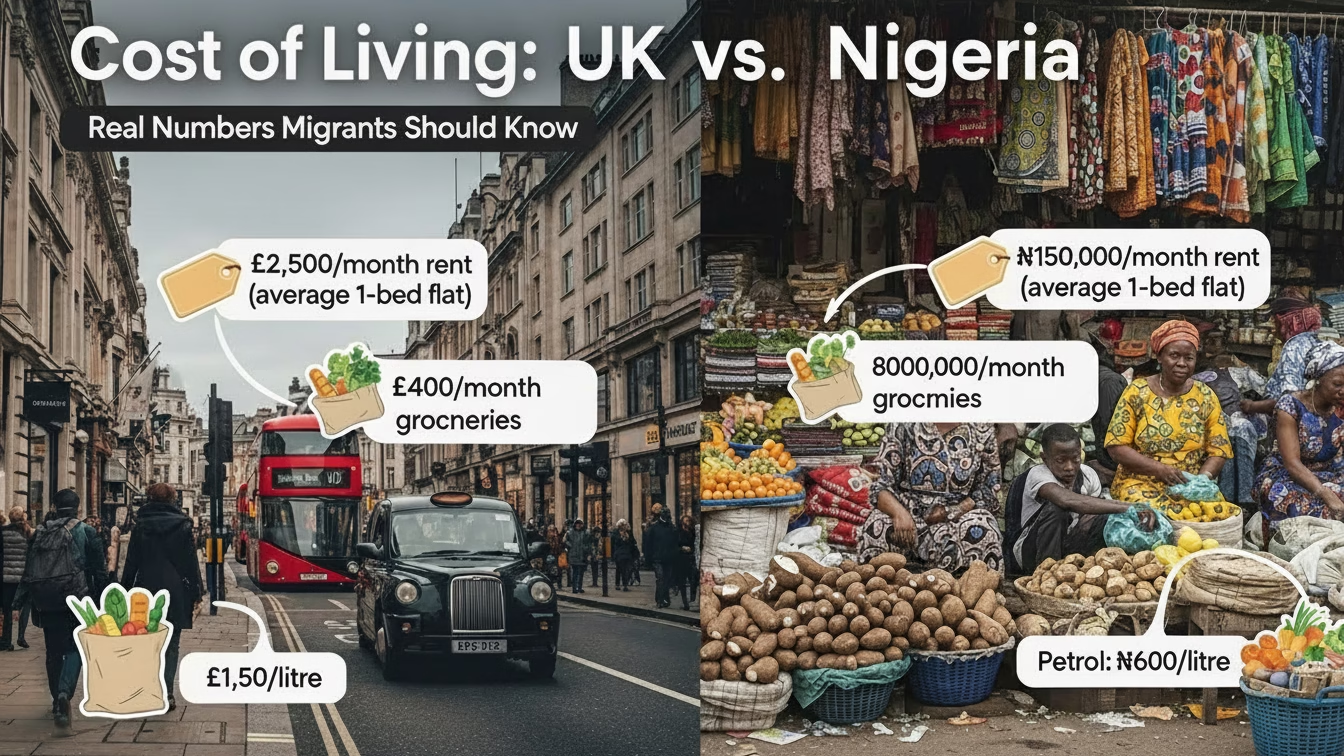

Housing Costs – For a 2 Bedroom Apartment in a middleclass residential area

- UK (Dagenham, London): £1,200 – £1,600 for a 2-bedroom apartment.

Nigeria (Lagos/Abuja): ₦800,000 – ₦2,000,000 per year.

Average monthly equivalent: ₦70,000 – ₦170,000.

Impact: UK rent can take up between 40-50% of income. Nigerian rent often about takes 7-15%. So, UK residential costs are quite high compared to Nigeria.

Transportation

- UK: £150 – £180 monthly for public transport (Train and buses)

- Nigeria: ₦100,000 – ₦150,000 (Train, buses, Uber, Fuel).

Impact: UK transportation is predictable but cost higher. Transportation is handled by the government and is very efficient. Driving is very expensive in the UK with cost of fuel and car parking charges.

Groceries & Food

- UK: £250 – £350 per month for a modest lifestyle.

- Nigeria: ₦150,000 – ₦250,000 depending on city and lifestyle.

Impact: Groceries are cheaper in the UK relative to income, but eating out is more expensive.

Utilities & Internet

- UK: £200 – £250 monthly (energy, heating, water, broadband).

- Nigeria: ₦60,000 – ₦120,000 (electricity, fuel for generator, internet)

Impact: Utilities such as light, heating, water, are quite expensive in the UK and unfortunately, you can not avoid paying those bills, unlike in Nigeria where people have devised various methods to circumvent these bills, but even for those that pay, the bills are still far less than what is paid in the UK. Bills for internet are cheaper in the UK and the internet is far more widespread and efficient than in Nigeria.

How Much Do You Really Take Home after TAX using average monthly figures?

UK Monthly Budget Breakdown

- Rent: £1,400

- Transport: £165

- Groceries: £300

- Utilities/Internet: £225

Total Expenses: £2,090; Net Remaining: £410

Nigeria Monthly Budget Breakdown

- Rent: ₦120,000

- Transport: ₦125,000

- Groceries: ₦200,000

- Utilities/Internet: ₦90,000

Total Expenses: ₦535,000; Net Remaining: ~₦965,000

The Big Picture

From the analysis above, the monthly disposable income for the family living in Nigeria, after adjusting for living costs seems so much better. Note that our analysis has not taken into consideration the children’s education or other sundry miscellaneous expenses. However, the person living in Nigeria on N1.5m per month can be seen to be more comfortable, even when these additional costs are included.

- UK disposable income: £410 (~₦820,000 equivalent)

- Nigeria disposable income: ₦965,000

Key Impact: In the UK, savings are easier to protect from inflation while in Nigeria, lifestyle comforts feel easier to maintain.

Conclusion

So, earning £3,000 in the UK vs. ₦1.5m in Nigeria is not automatically “better” as those intending to Japa are wont to believe. The UK offers stability, security, predictable bills, and currency strength, but it comes with heavier monthly living expenses while Nigeria offers higher lifestyle flexibility but with less security and economic stability. For anyone planning to migrate, the real question is: What matters more to you – stability or comfort?